Sensational Tips About How To Reduce Refinance Closing Costs

Points generally cost 1% of your.

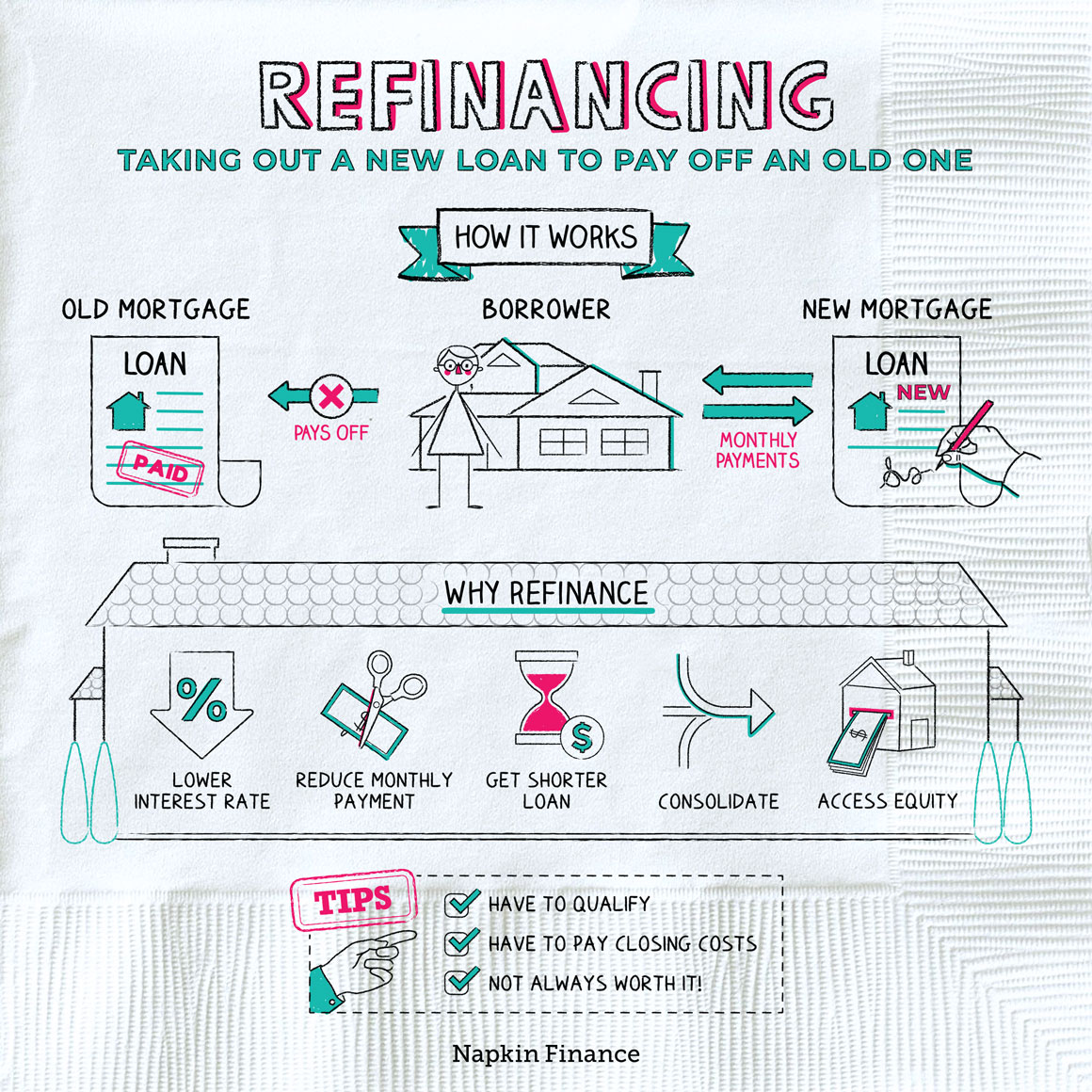

How to reduce refinance closing costs. If you see a fee that is. One of the simplest ways for you to reduce your closing costs as a buyer is to schedule your closing at the end of the month. Borrowers need the same discipline when seeking out a mortgage refinance as they do when looking for a great deal on a new sofa.

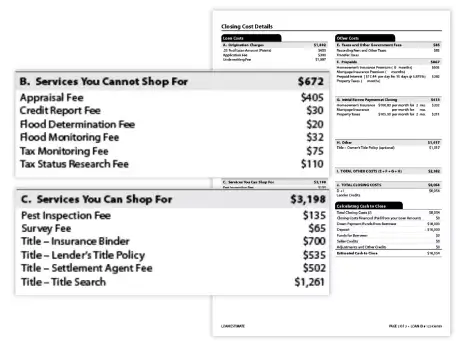

Ask your lender for an appraisal waiver. Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. You can reduce closing costs by comparing and negotiating lender fees, asking the seller to contribute and closing the loan near the end of the month.

Your lender may be willing to waive or. Since every lender offers different interest. 2 days agothe best mortgage refinance companies have a lot to offer homeowners, but finding the right fit will depend on a borrower’s specific circumstances.

You can choose to reduce your interest rate by 0.25% for each point you buy. Homeowners who don’t have the money saved for closing costs can ask their lende… this strategy may work in your favor if you plan on refinancing again or don’t plan to stay in your home for more than five years. How to negotiate lower refinance closing costs #1 application fee.

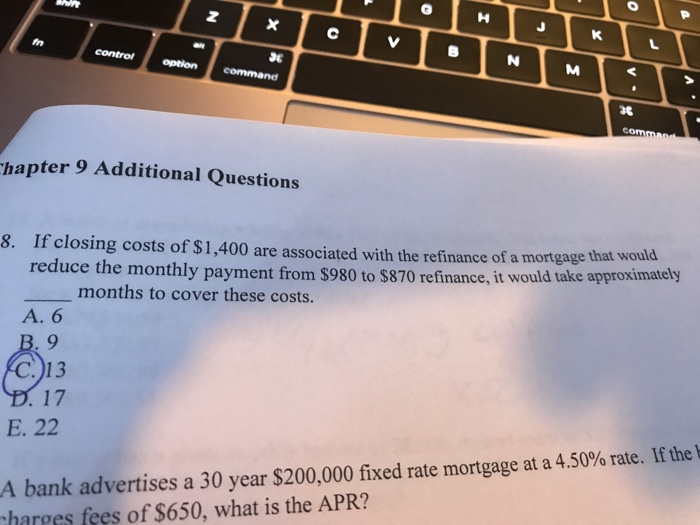

Just be sure to provide breathing room for last minute issues that could delay the closing. The average cost for this fee is between $300 and $450. If you can’t waive the appraisal altogether, you may be able to save money by opting for an automated appraisal instead of a full appraisal.

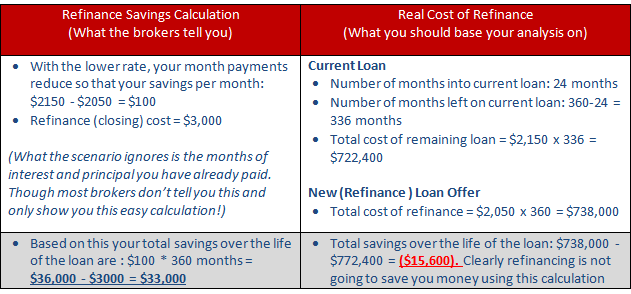

You can pay extra at closing to reduce your interest rate. As of last year, the average closing costs to refinance a mortgage was 1.5%. You break even sooner with the.

A typical fee for applying for a mortgage will be between $250 to $300. Shop around for mortgage lenders mortgage refinance lenders compete for your business just like grocery stores and. The extra interest payments often won’t be as much as th… see more

To lower your refinance closing costs ask for a waiver in some of the fees or the bank or mortgage lender may even pay them for you, to keep you as a customer. No closing cost refinance mortgage, lowest. This tells you how many months it will take you to break even on the expense of.

Marilyn lewis may 31, 2019. Say you have 15 years left on a $200,000 mortgage at 8.5% on a home originally worth $250,000. This figure varies depending on your type of loan and fico score.

It is easier to do this on refinance transactions where the borrower is in total. Challenge lender fees you’re likely to see an assortment of fees, including courier. You want to refinance to take advantage of the current lower rate of 6.22%.