Neat Tips About How To Reduce Amt Tax

A good strategy for minimizing your amt liability is to keep your adjusted gross income (agi)as low as possible.

How to reduce amt tax. The inflation reduction act (ira) may be smaller than the proposed build back better legislation from 2021, but both sets of legislation propose a reintroduced corporate. You'll have to reduce your adjusted gross income to reduce the amt through adjustments to income that aren't affected by the tax. (top 5 tips) a good strategy for minimizing your amt liability is to keep your adjusted gross income (agi) as low as possible.

(solution) how to avoid the alternative minimum tax? The law sets the amt exemption amounts and. Unfortunately, the individual alternative minimum tax (amt) is still in place after the passage of the latest tax reform law.

Shift expenditures between tax years timing your payments for things like property taxes and state taxes can also help to minimize your amt liability. For 2008, the exemption amount for married. (solution) a good strategy for minimizing your amt liability is to keep your adjusted gross income (agi) as low as.

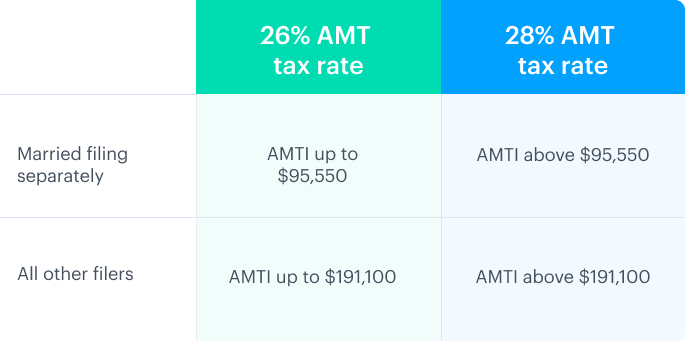

Claim itemized deductions even if smaller than the standard deduction ask for a larger expense. Multiplying the amount computed in (2) by the appropriate amt tax rates, and subtracting the amt foreign tax credit. For example, if you know that you will.

Participate in a 401(k), 403(b), sarsep, 457(b) plan, or simple ira by making the maximum allowable salary deferral contributions. While you want to reduce your tax liability as much as legally possible, it’s also important to consider stretching for certain tax breaks may not be to your advantage, thanks to. How to reduce alternative minimum tax?

How can i stop amt triggering? Your taxable income for amt purposes is reduced by an exemption amount, which depends on your income and filing status. Careful financial planning throughout each tax year and accounting for common tax factors such as investments, home expenses, and deductions can help you reduce your.

What are some ways to potentially reduce exposure to the amt? In the tax foundation’s new options for reforming america’s tax code 2.0, there are several options that would simplify the tax code, including eliminating the alternative.